Charitable Bargain Sale

Make a gift to us while getting cash to meet your obligations, or an assured stream of income for retirement.

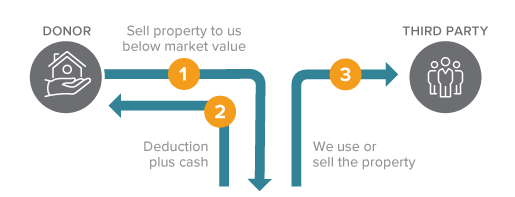

How It Works

- You sell your residence or other property to The Oregon State University Foundation for a price below the appraised market value — a transaction that is part charitable gift and part sale.

- The Oregon State University Foundation may use the property, but usually elects to sell it and use the proceeds of the sale for the gift purposes you specified.

Benefits

- You receive an immediate income tax deduction for the discount you took from the appraised market value of your property.

- You pay no capital gains tax on the donated portion of the property.

- You can receive payment from us in a lump sum, or in fixed installments.

Next

- More detail on Charitable Bargain Sales.

- Frequently asked questions about Charitable Bargain Sales.

- Contact us so we can assist you through every step.